You can now compare your 1st column with the last period’s closing balances or the 1st day of this period’s balances to ensure accuracy. This makes it easier to prepare financial statements since they will contain one less step. This report captures what the business owns and owes without any adjustments for revenue earned but not yet received or expenses incurred but not yet paid. Tax accountants and auditors also use this report to prepare tax returns and begin the audit process. This will ensure all revenues, expenses, gains, and losses are accounted for. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Why You Can Trust Finance Strategists

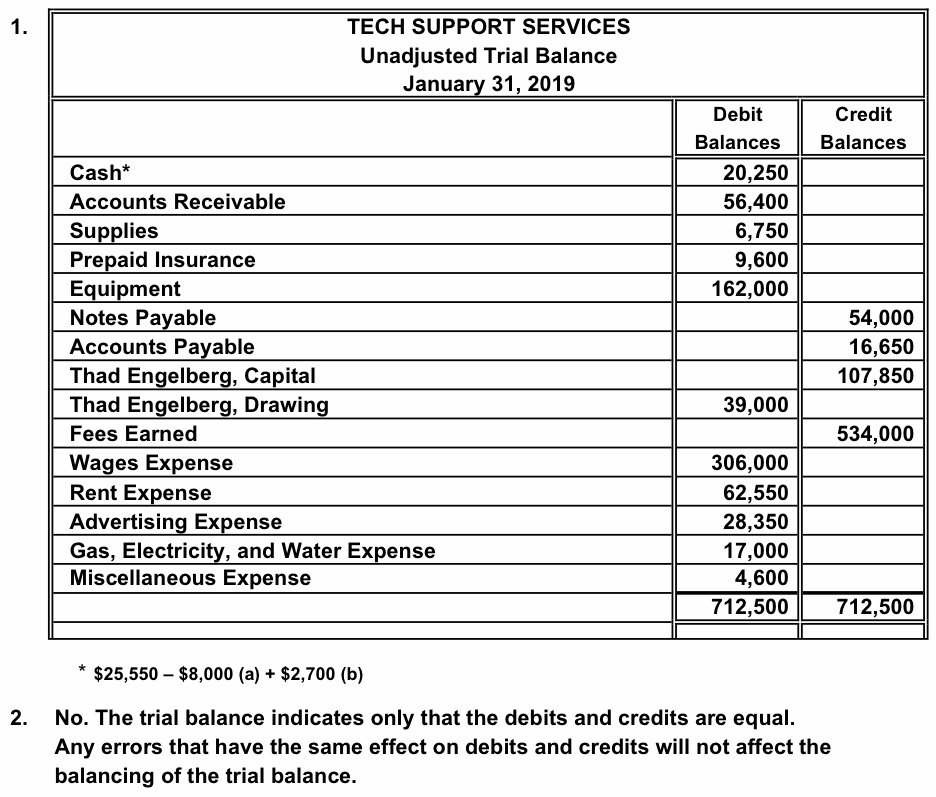

An unadjusted trial balance is prepared to ensure the accounts identify the errors and mistakes that may be present in the records so that the same could be avoided at the later stages. Basically, each one of the account balances is transferred from the ledger accounts to the trial balance. All accounts with debit balances are listed on the left column and all accounts with credit balances are listed on the right column. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other.

To Ensure One Vote Per Person, Please Include the Following Info

If the final balance in the ledger account (T-account) is a debit balance, you will record the total in the left column of the trial balance. If the final balance in the ledger account (T-account) is a credit balance, you will record the total in the right column. It will allow you to spot-check the accuracy of the first step in preparing your company’s financial statements – that is, entering balances from your account ledger into a spreadsheet.

How confident are you in your long term financial plan?

It’s like a health check for your accounts before you make any changes. With this tool, we can spot mistakes early and ensure every transaction is in the right place. Accountants call this process ‘balancing the accounts.’ It shows if total debits equal total credits as they should. Accountants look at the unadjusted trial balance to check the account balances.

Fact Checked

- Also, a full heading and account numbers usually appear on the unadjusted trial balance.

- After the all the journal entries are posted to the ledger accounts, the unadjusted trial balance can be prepared.

- Its purpose is to test the equality between total debits and total credits.

- Now, most companies use an accounting system where the system automatically creates the trial balance.

Unadjusted trial balance numbers are simply the account balances from the general ledger. Once all balances are transferred to the unadjusted trial balance, we will sum each of the debit and credit columns. The debit and credit columns both total $34,000, which means they are equal and in balance. However, just because the column totals are equal and in balance, we are still not guaranteed that a mistake is not present. A balanced trial balance hints at no apparent accounting error, whereas discrepancies imply an error somewhere in the account balances.

While the former is about noting down the transactions roughly, the latter is the means of presenting data in proper order. Once you have entered all of your transactions for this accounting period, the 1st and 2nd columns of UBTB will contain the opening and closing balances for each account. Note that while a trial balance is helpful in the double-entry system as an initial check of account balances, it won’t catch every accounting error.

The accountant will need to trace and find the discrepancy to ensure the debits and credits are equal. First, the account balances from the general ledger and subsidiary ledgers are transferred to a trial balance. Next, these balances are listed in balance sheet and income statement order with their debit and credit balances.

To embark on the preparation of an gross pay vs net pay, one must meticulously gather and synthesize data from the general ledger—a foundational step that sets the stage for accurate financial reporting. The unadjusted trial balance takes center stage before year-end adjustments enter the picture. It lays out raw financial data straight from the accounting records, serving as evidence of all monetary transactions up until that moment. Moving from the broad concepts of accounting, let’s focus on the unadjusted trial balance. It lists every general ledger account along with its respective balance at a particular time.