The credit sales journal entry is an important accounting entry for businesses. With this method, transactions are abnormally recorded in two or more accounts simultaneously. These entries generally involve a credit to one or more accounts and a debit to one or more accounts. These entries are normally equal but opposite; thus when one account increases, the other decreases. Additionally, the amounts recorded must be equal to each other; a credit of $10 to an account must be followed by a debit of $10 to another account.

Cash Flow Statement

- Only inventory and other merchandise sales are recorded in the sales journal.

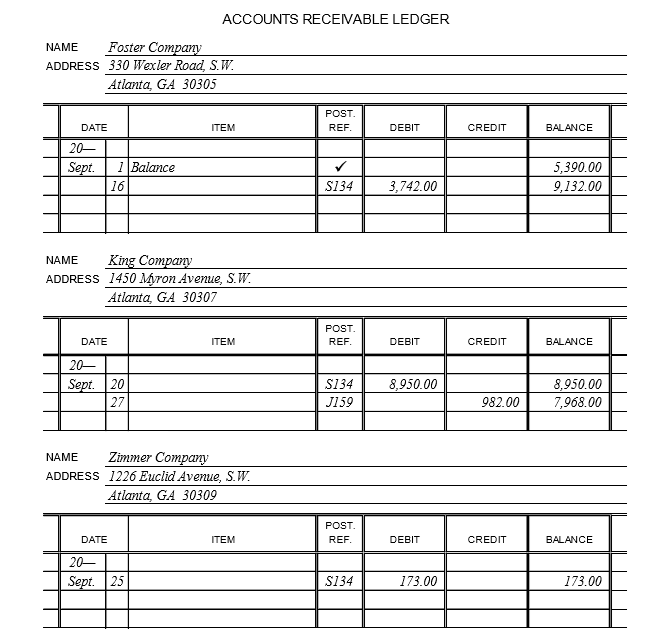

- By recording each customer’s credit sales in the journal, businesses can easily see who owes them money and how much.

- The journal entry includes a debit to the Accounts Receivable and a credit to the Sales account.

- There are basically two journal entries made to record credit sales; first when the good or service is purchased and then later on when the good or service is paid for.

- By clearly documenting all sales credits, businesses can avoid errors and ensure that customers are properly credited for their purchases.

The sales journal is simply a chronological list of the sales invoices and is used to save time, avoid cluttering the general ledger with too much detail, and to allow for segregation of duties. The sales journal records all credit transactions involving the firm’s products. Only inventory and other merchandise sales are recorded in the sales journal. Credit sales are reported on both the income statement and the company’s balance sheet. On the income statement, the sale is recorded as an increase in sales revenue, cost of goods sold, and possibly expenses. Woodworks, Inc. wants to write off the uncollected credit sales as bad debts expense.

Example – Journal Entry for Cash Sales

Now we will understand how to show all the above entries in financial statements. For example, if you notice that your sales spiked during a certain week in the past, you might want to try to replicate that promotion or sale again. Apple Inc., a retailer of laptops and computers, gave Jimmy Electronics credit for $50,000 worth of items on May 1, 2020. Consider the same example above – Company A selling goods to John on credit for $10,000, due on January 31, 2018. However, let us consider the effect of the credit terms 2/10 net 30 on this purchase. Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

Double Entry Bookkeeping

This is a key competitive tool in some industries as it can attract additional customers through the provision of longer payment terms. These payment delays can therefore be beneficial for both the buyer and the seller, allowing customers to take advantage of goods and services and generating additional revenues for the seller. Each sale invoice is recorded as a line item in the sales journal as shown in the example below. If you have a complete and accurate sales journal, it will make preparing your business taxes much easier come tax time. On 31st April 2020, ABC Inc. sold XYZ Inc. products worth $1,000 that are subject to a 10% tax. In the aforementioned illustration, Apple Inc. is providing a 10% discount to Jimmy Electronics if they pay by May 10 or earlier.

Accounting for Credit Sales

Each of these three types of sales transactions has their own advantages and disadvantages. If your business is ever audited by any government agency, the sales journal will be one of the first places they look. The sale date, the buyer’s name, the purchase price, and the amount owed by the buyer must all be included in the sales credit log entry.

How to show Credit Sales in Financial Statements?

The buyer then has a certain period of time, known as the credit term, in which to pay the seller back. These potential disadvantages should be taken into consideration when making the decision to offer credit sales to customers. Careful analysis and appropriate risk management strategies can help to minimize the negative impacts of offering credit sales. Some businesses simply have one credit sales journal entry column to record the sales amount whereas others need additional columns for sales tax, delivery fees charged to customers etc. The multi-column journal should always have an ‘other’ column to record amounts which do not fit into any of the main categories. If the customer later pays off the balance owed, you would then make a second journal entry that reverses the original transaction.

We hope that now you understand that a sales credit journal entry is an important accounting activity that documents the cancellation of a sale, frequently as a result of returns, refunds, or allowances. By reporting revisions to income and accounts receivable, it ensures transparency and complies with accounting rules, assisting in maintaining accurate financial records. Businesses must properly record sales credits in order to track their financial success and safeguard the accuracy of their financial statements. When companies offer credit to customers, the customers receive goods or services from the company without paying for them immediately.

On January 1, Little Electrode, Inc. sells a computer monitor to a customer for $1,000. Little Electrode, Inc. purchased this monitor from the manufacturer for $750 three months ago. The Sales account is an income statement account that records the revenue earned by a company from the sale of its products or services. It represents the total amount of money that a company has earned from its sales during a particular period. Net credit sales refer to the revenues generated by selling goods on credit to customers.

It involves a debit to the accounts receivable and a credit to the sales account. It is an especially common journal entry for companies who sell goods on consignment or offer a long payment duration for goods purchased. A credit sales journal entry is used to record the revenue from a customer’s purchase on credit. This type of journal entry is important because it helps businesses keep track of the money that is owed to them by customers. This information is useful in many different ways, such as when businesses are trying to budget for the future or when they are preparing financial statements.